UK BR20NSP (Formerly BR20) 2020-2024 free printable template

Show details

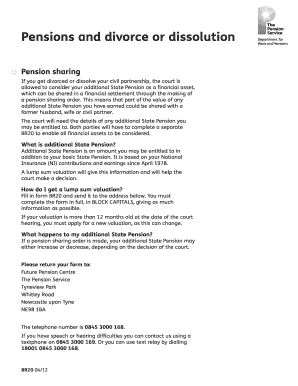

To get the Cash Equivalent Value we need information from you and the other person involved in the divorce or dissolution. Both of you need to complete your own copy of the BR20NSP form and send it to us. BR20NSP 01/20 Fill in all parts of the form in full with black ink and CAPITALS giving as much information as possible. State Pensions and divorce or dissolution* Application for a valuation If you get divorced or end your civil partnership the court can treat your State Pension as a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your br20 form 2020-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your br20 form 2020-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit br20 form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit br20nsp form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

UK BR20NSP (Formerly BR20) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out br20 form 2020-2024

How to fill out br20 form:

01

Obtain the br20 form from the appropriate government agency or website.

02

Carefully read the instructions provided with the form to understand the requirements and any supporting documents needed.

03

Begin by filling out personal information such as your name, address, contact details, and social security number.

04

Answer all the questions in the form accurately and truthfully. Provide any required details regarding your employment, income, and financial situation.

05

Double-check all the information you have provided to ensure accuracy and completeness. Make sure to sign and date the form where required.

06

Attach any necessary supporting documents as specified in the instructions.

07

Once the form is complete and all required documents are attached, review everything once again to ensure compliance with the guidelines.

08

Submit the filled-out br20 form and any supporting documents as instructed. Keep a copy for your records.

Who needs br20 form:

01

Individuals who are applying for or receiving certain government benefits may need to fill out the br20 form.

02

This form is often required for individuals seeking assistance or support from government social programs.

03

In some cases, individuals who are experiencing financial hardship or significant life changes may also be required to complete the br20 form to assess eligibility for specific benefits.

Video instructions and help with filling out and completing br20 form

Instructions and Help about br20 form pension

Fill br20 form download : Try Risk Free

People Also Ask about br20 form

How is a pension for divorce valued?

Can I claim ex husband's pension?

What is a cash equivalent transfer value for divorce?

What is the Cetv pension divorce?

What is a BR20?

How do I get a CETV for divorce?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

When is the deadline to file br20 form in 2023?

The deadline to file the BR20 form in 2023 is April 30, 2024.

What is br20 form?

The term "BR20 form" is not clear and can refer to different things in different contexts. It is possible that "BR20 form" refers to a specific form in a specific field or jurisdiction. Without further context, it is difficult to provide a specific answer.

How to fill out br20 form?

To fill out a BR20 form, follow these steps:

1. Download the BR20 form from the official HM Revenue and Customs (HMRC) website or obtain it from a local tax office.

2. Start by filling out your personal details, such as your full name, date of birth, National Insurance number, and address.

3. Next, provide details about your employment, including your employer's name and address, your job title, and the dates you started and ended employment. If you had multiple employments within the tax year, you may need to attach additional pages or use a separate form for each employment.

4. Move on to declaring your pension income. If you received a pension payment or lump sum withdrawal during the tax year, you need to provide information about the pension provider, type of pension, amount received, and the date it started or ended.

5. Indicate whether you received any other taxable income, such as rental income or income from investments. If yes, provide details about the type of income, amount received, and relevant dates.

6. If you made any charitable donations through Gift Aid, provide details of these donations, including the name of the charity, the amount donated, and the tax year in which it was made.

7. Review the form to ensure all information is accurate and complete. If you need to make any corrections, cross out the incorrect information and provide the correct details next to it.

8. Sign and date the form to confirm that the information provided is true and accurate.

9. Keep a copy of the completed form and any supporting documentation for your records.

10. Send the completed form to the address provided on the form or submit it online through the HMRC website, if applicable.

Please note that the form's guidance notes may provide further instructions specific to your situation, so it is advisable to consult them while filling out the form. If you are unsure about any aspect of the form, consider seeking assistance from a qualified tax professional or contacting HMRC directly for clarification.

What is the purpose of br20 form?

The purpose of the BR20 form is to request a State Pension forecast. This form allows individuals to find out how much State Pension they might receive in the future and provides an estimate of their entitlement based on their National Insurance record. It helps individuals plan for their retirement and make informed financial decisions.

What information must be reported on br20 form?

The BR20 form is a statutory form used to notify Companies House of the appointment of a person as a company's secretary. The following information must be reported on the BR20 form:

1. Company details: The name of the company, registered number, and the date of the appointment of the new secretary.

2. New Secretary's details: The full name, residential address, date of birth, and nationality of the new secretary.

3. Service address: The new secretary's service address, which is the official address used by Companies House for correspondence.

4. Usual residential address: If the service address is the same as the residential address, this should be indicated. However, if they are different, the usual residential address should be provided.

5. Occupation: The new secretary's occupation or former occupation, if applicable.

6. Other directorships: Details of any other directorships or company secretarial appointments held by the new secretary, including the company name, registration number, and registration country.

7. Date of appointment: The date the new secretary was appointed to the company.

8. Signature and date: The form must be signed and dated by the new secretary, or by a person authorized to sign on their behalf.

It is important to note that the specific requirements may vary depending on the jurisdiction, so it is always advisable to consult the relevant government regulations or seek professional advice when completing the form.

How can I manage my br20 form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your br20nsp form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get br20 form online?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific uk br20 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit br20 form get online?

With pdfFiller, it's easy to make changes. Open your br20 pensions form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your br20 form 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

br20 Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to form br20 form

Related to br20 state pension form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.